An International Benchmarking of Energy and CO2 Intensities

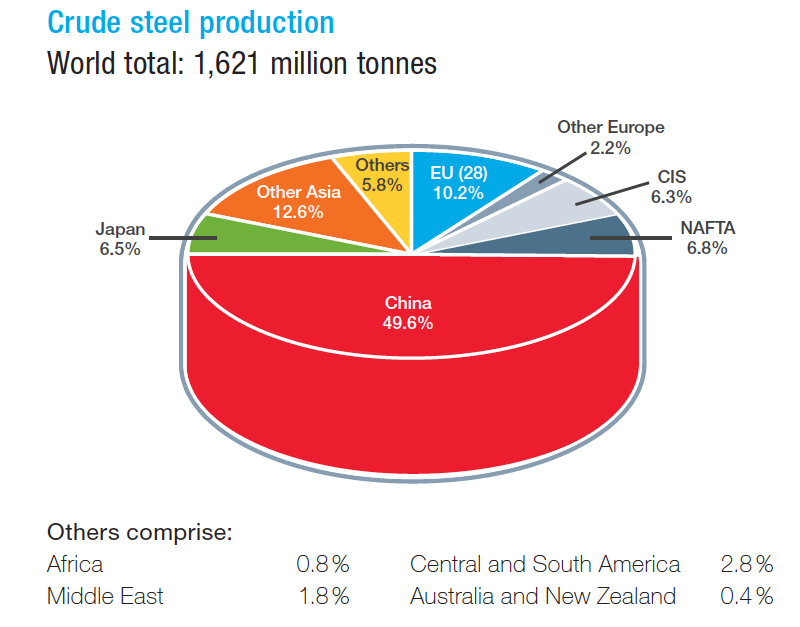

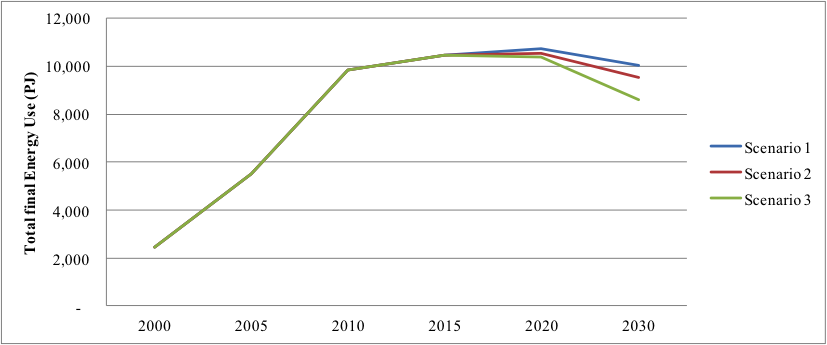

The iron and steel industry accounts for around a quarter of greenhouse gas (GHG) emissions from the global industrial sector. Global steel production has more than doubled between 2000 and 2018. China accounted for 51 percent of global steel production in 2018. The energy use and GHG emissions of the steel industry is likely to continue increasing because the increased demand for steel, particularly in developing countries, is outpacing the incremental decreases in energy and CO2 emissions intensity of steel production that are happening under the current policy and technology regime.

In this study, which was supported by the BlueGreen Alliance Foundation, we conduct a benchmarking analysis for energy and CO2 emissions intensity of the steel industry among the largest steel-producing countries. Because of the difference in the composition of the steel industry across countries and the variation in the share of electric arc furnace (EAF) steel production, a single intensity value for the overall steel industry is not a good indicator of efficiency of the steel industry in a country. Therefore, in addition to calculating energy and CO2 intensities for the entire steel industry, we also calculated separately the intensities associated with the EAF and blast furnace–basic oxygen furnace (BF-BOF) production routes in each country.

Our results show that when looking at the entire steel industry, Italy and Spain have the lowest and China has the highest energy and CO2 emissions intensities among the countries studied. Among several reasons, this is primarily because of a significantly higher share of scrap-base EAF steel production from total steel production in Italy and Spain and a very low share of EAF steel production in China. The U.S. steel industry’s final energy and CO2 emissions intensities rank 4th lowest among the countries studied.

To read the full report and see complete results and analysis of this new study, Download the full report from this link.

Don't forget to Follow us on LinkedIn , Facebook and Twitter to get the latest about our new blog posts, projects, and publications.