Green Steel Economics

Comparing the Economics of Green H2-DRI and Traditional Steelmaking Around the World

Ali Hasanbeigi, PhD (Lead Author) - Global Efficiency Intelligence, United States

Cecilia Springer, PhD - Global Efficiency Intelligence, United States

Bonnie Zuo - TransitionAsia, Hong Kong

Alastair Jackson - TransitionAsia, Norway

Daseul Kim - Solutions for Our Climate (SFOC), South Korea

Esther Haerim Heo - Solutions for Our Climate (SFOC), South Korea

The global steel industry accounted for over 7% of global greenhouse gas (GHG) emissions and over 11% of global CO2 emissions. The urgency to align with the Paris Climate Agreement’s targets necessitates substantial CO2 reductions in this sector by 2050, with considerable near-term actions. The Hydrogen Direct Reduced Iron (H2-DRI) process utilizing green hydrogen made with renewable/no-carbon electricity promises significant emission reductions and a transition to greener steel production in the sector.

The adoption of green H2-DRI-EAF steelmaking involves financial considerations varying by country, influenced by hydrogen costs and carbon pricing mechanisms. The study assesses the costs of green H2-DRI-EAF steelmaking compared to traditional Blast Furnace-Basic Oxygen Furnace (BF-BOF) and Natural Gas Direct Reduced Iron-Electric Arc Furnace (NG-DRI-EAF) routes across seven major steel-producing countries, including the U.S., EU, China, Japan, South Korea, Brazil, and Australia. It utilizes a detailed financial model to calculate the levelized cost of steel (LCOS) using expenses such as capital investments, raw materials, labor, and energy costs, adjusting for varying levels of hydrogen use. The key questions answered by this report are: 1) How much is the green steel premium per ton of steel in each country? 2) How much is the green steel premium per unit of final product (car, building, ship) in each country? 3) How different H2 prices and carbon pricing can influence the green steel premium in each country?

Green Steel Premium Results

This shift to green H2-DRI is initially more costly and results in a so-called "green premium". Figure 1 illustrates the green steel premium comparison across various countries, showing the cost of steel production using both traditional and green H2-DRI-EAF steelmaking routes at different H2 price points. For example, with H2 priced at $1.0/kg, the LCOS for the green H2-DRI-EAF route is lower than that of conventional steelmaking routes, providing a compelling economic case for its adoption without relying on subsidies or carbon pricing strategies.

Figure 1: Levelized Cost of Steel ($/t crude steel) for BF-BOF, NG-DRI-EAF and green H2-DRI-EAF in countries studied (Source: this study)

Notes: Assumed 5% steel scrap is used in both BF-BOF and DRI route. No carbon price is considered.

The cost of producing green H2 is currently higher than natural gas but is expected to significantly decrease as early as 2030. The Levelized cost of H2 (LCOH) in 2030 is forecasted to be in a range that makes green H2-DRI-EAF be cost-competitive with NG-DRI-EAF in many countries at H2 prices below $2/kg H2. At these H2 prices, the green H2-DRI-EAF nears parity with greenfield BF-BOF steelmaking cost.

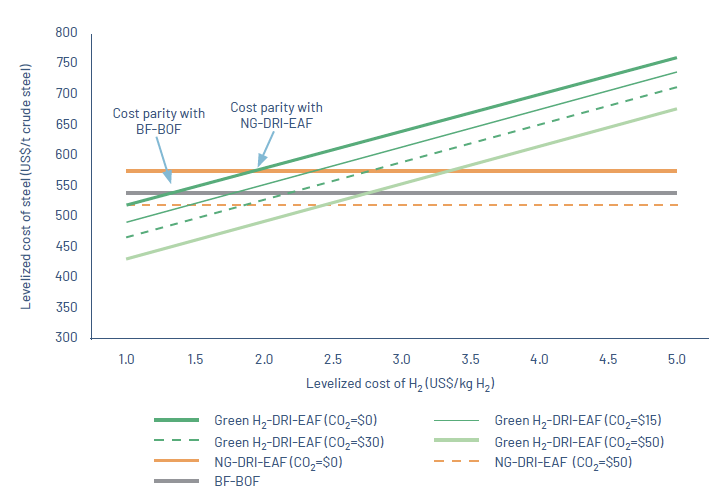

Figure 2 shows the green steel premium in China across varying H2 prices and carbon pricing scenarios. At $0 CO2 price, the cost for green H2-DRI-EAF steelmaking is the highest, requiring H2 prices to drop to about $2/kg to be competitive with NG-DRI-EAF methods. Introducing a carbon price shifts this dynamic significantly. With a $15/ton CO2 price, green H2-DRI-EAF at $1.5/kg H2 undercuts the BF-BOF cost ($539/ton). As the carbon price rises to $30 and $50 per ton, green H2-DRI-EAF becomes increasingly competitive, achieving cost parity with BF-BOF at higher H2 prices. The graph shows that at a CO2 price of $30, the LCOS aligns with BF-BOF when H2 is priced below $2.2/kg, and it becomes even more competitive at higher carbon prices of $50, reaching cost parity at H2 prices just over $2.8/kg. This trend indicates a strong influence of carbon pricing on the economic feasibility of adopting green H2-DRI-EAF steel production. Similar results were observed regarding the impact of carbon pricing in other countries.

Figure 2. Levelized Cost of Steel ($/t crude steel) with varied levelized costs of H2 at different carbon prices in China (Source: this study)

Notes: Assumed 5% steel scrap is assumed to be used in both BF-BOF and DRI routes. For this analysis, it is assumed that carbon pricing will be applied in the form of credits or allowances for green H2-DRI-EAF plants. Eligible plants would receive carbon credits based on the reduction of their carbon intensity relative to the benchmark set by BF-BOF operations, which can then be traded on the carbon market.

Impacts on the End-use Sectors

As green steel incurs a cost premium, this directly affects the material costs of downstream use sectors. This report has analyzed the potential cost increases related to three notable downstream sectors: automobile, construction, and shipping, using steel produced via the H2-DRI-EAF method compared to conventional methods for those sectors.

The global automotive industry accounts for 12% of global steel demand. The impact of the green steel premium on car prices demonstrates a minimal overall effect. For example, in Japan, when the price of H2 is $5/kg, the additional cost per ton of steel using the green H2-DRI-EAF method is about $231, leading to an extra $208 per passenger car, which represents less than a 1% increase on the average passenger car price of $28,000 in Japan. Projections indicate that with potential reductions in H2 costs to $1.3/kg, the green premium could vanish, making green H2-DRI-EAF prices comparable to traditional BF-BOF steel costs in Japan. Moreover, the introduction of a carbon pricing mechanism could further decrease this green premium, enhancing the affordability and market viability of using green H2-DRI-EAF steel in automotive manufacturing. Similar results in terms of the impact of H2 price and carbon pricing on green steel premiums in auto manufacturing were observed in other countries studied, as shown later in this report.

Similarly, the economic impact of using green H2-DRI-EAF steel in building construction is quite minor compared to traditional BF-BOF steelmaking. For example, in China, at a hydrogen cost of $5/kg, the green premium for steel is about $225 per ton. This translates into an additional cost of roughly $563 for a 50 m² new residential unit (assuming 50 kg of steel per m²), which is a small portion of the overall cost of purchasing such a residential unit. Future reductions in hydrogen costs or the implementation of carbon pricing could also reduce or eliminate this green premium, potentially making green H2-DRI-EAF steel a cost-effective alternative for construction in China and other countries. The construction industry (building and infrastructure) accounts for 52% of global steel demand.

Incorporating green H2-DRI-EAF steel into shipbuilding shows only a modest increase in costs. With hydrogen priced at $5/kg, the green premium per ton of steel in China is $225. For a 40,000 DWT (Deadweight tonnage) bulk ship, which typically uses about 13,200 tons of steel, this translates to an additional $3 million per ship. Given the typical price of a 40,000 DWT (Deadweight tonnage) bulk ship is over $30 million, the green premium represents around 10% cost increase. The reason for this relatively higher green steel premium as a share of the total cost for shipbuilding compared to cars and buildings is the higher share of steel cost in the shipbuilding cost. Over 95% of a ship consists of steel. However, it should be noted that the top three shipbuilding nations, China, South Korea, and Japan, account for over 90% of global shipbuilding. Therefore, the green premium discussion for shipbuilding mostly matters in these three countries. In addition, shipbuilding accounts for a small share (around 3%) of global steel demand and does not have to be a market leader in green H2-DRI-EAF steelmaking. As the price of H2 drops and green steel premium decreases substantially, the use of green H2-DRI-EAF steel in the shipbuilding sector can be considered.

Although the green steel premium analysis varies by plant, our results provide a good initial investment guide across countries. Showing costs for various hydrogen and carbon prices aids decision-making by the government and steel industry. Despite significant green premiums per ton of steel, the premium per unit of the final product (cars or buildings) is negligible, making the overall conclusions relevant for any specific site.

Financing and Recommendations

The financing of H2-DRI projects is crucial for the transition, utilizing both public and private funding to mitigate financial risks associated with green H2-DRI technology. Notable instances include H2 Green Steel (H2GS) in Sweden, securing €1.5 billion in equity financing in 2023, followed by over €4 billion in debt financing, supported further by a €250 million grant from the EU Innovation Fund. In Germany, Salzgitter AG's SALCOS program received approximately €1 billion in subsidies for a new H2-DRI plant. Similarly, ArcelorMittal's German project received €1.3 billion from the European Commission's Recovery and Resilience Facility to support new electric arc furnaces and a H2-DRI plant. Sweden's HYBRIT initiative, involving SSAB, LKAB, and Vattenfall, was notably backed by a SEK 3.1 billion grant from the Swedish Energy Agency. In the U.S., the Department of Energy recently announced $1 billion to support two H2-DRI projects in the U.S.

Finally, we recommend strategies for different stakeholders to support the adoption and expansion of green H2-DRI-EAF steelmaking around the world and how to address the initial green premium. Governments are urged to enact supportive policies like tax rebates and other incentives for green H2 production, alongside investments in R&D and infrastructure to lessen green hydrogen costs. Power market reforms are needed in some countries to help increase renewable electricity generation for green H2 production at lower cost. Public procurement policies can boost market demand and mitigate financial risks for green H2-DRI steel producers by prioritizing the use of green steel in publicly funded projects.

Steel companies are encouraged to transition from traditional BF-BOF routes to green H2-DRI by forming partnerships for a reliable green hydrogen supply and by engaging in industrial-scale pilot projects. They should also secure market demand through long-term supply agreements with major end-use sectors, which could involve sharing the costs of the green premium.

Automotive and construction companies can integrate green steel into their procurement strategies to stimulate demand and help cover the green premium. Automotive companies in particular can also enhance their market positioning by promoting the climate, environmental, and health benefits associated with a transition to green steel and reduction of coal-based steelmaking in their supply chains, while construction firms can engage in green private procurement to cater to climate-conscious clients.

Major shipbuilding and shipping companies are recommended to utilize both public and private procurement strategies to boost adoption of green steel, thus reducing the green premium through government policies and commercial agreements. Establishing robust supply chains with green H2-DRI steel manufacturers is essential to ensure a steady demand for green steel, promoting its broader adoption in the industry.

To read the full report and see complete results and analysis of this new study, Download the full report from the link above.

Interested in data and decarbonization studies on the global steel industry? Check out our list of steel industry publications on this page.