Electrifying Industrial Heating in China

Authors: Ali Hasanbeigi, Cecilia Springer - Global Efficiency Intelligence

Jibran Zuberi, Hongyou Lu, Nan Zhou - Lawrence Berkeley National Lab

The industrial sector in China accounts for roughly 65% of China’s total primary energy use and 70% of its energy-related CO2 emissions. As emissions from electricity generation decline, addressing thermal energy needs in the industrial sector, especially for process heating, will become a critical challenge in the pursuit of deep decarbonization of industry.

Heat represents two-thirds of all energy demand in the industrial sector, yet very little of this demand is met with renewable energy sources. A significant opportunity lies in decarbonizing the industrial sector by transitioning heat production away from carbon-intensive fossil fuels and towards cleaner alternatives such as electrification, where low- or zero-carbon electricity is utilized.

In this report, we analyze the electrification potential for 14 industries in China (aluminum, container glass, ammonia, recycled plastic, beer, beet sugar, milk powder, wet corn milling, soybean oil, meat, steel, steel reheating, ethanol, and pulp and paper). We also analyzed the energy and CO2 emissions impacts of electrification of boilers in Chinese industrial subsectors over time.

The report identifies specific processes that could be electrified in the near term with commercially available technologies and analyzes the expected changes in energy use, CO2 emissions, and energy costs. Understanding which conventional processes could be electrified and how this impacts emissions and costs can help industrial facilities identify which of their processes may be suitable candidates for electrification. In addition, understanding the potential growth in industrial energy demand that will result from electrification can help utilities, grid operators, and electricity generators plan for these changes and ensure equipment and generation resources are available to meet the growing demand for renewable electricity.

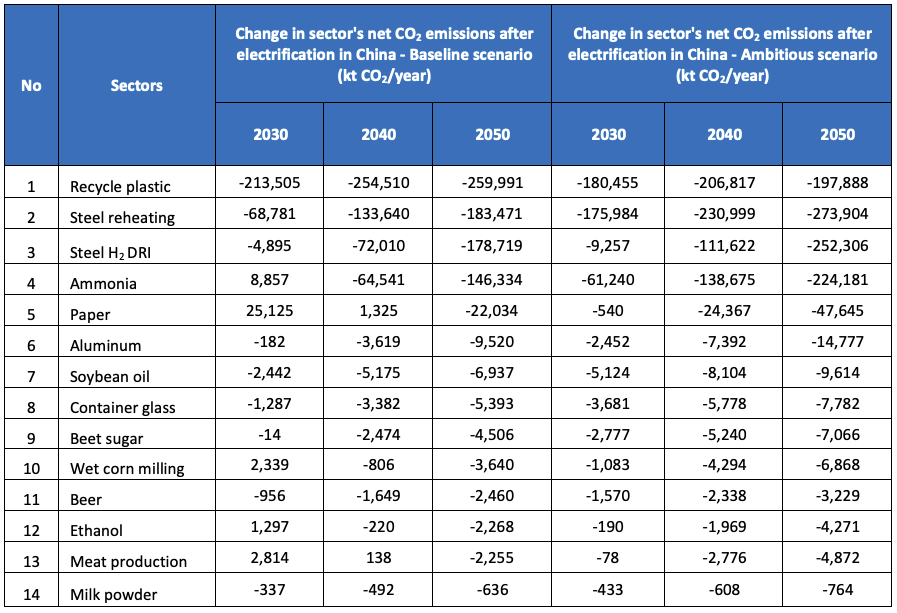

Table ES1 shows the change in CO2 emissions after electrification of certain processes in those industries (assuming a 100 percent adoption rate, except for the steel industry). Negative values imply a reduction in emissions. The baseline scenario assumes a net zero grid is achieved by 2060 according to China’s current commitments under the Paris Agreement, whereas in the ambitious scenario, it is assumed that facilities will be able to procure renewable electricity for one-third of their electricity needs in 2030, half by 2040, and all by 2050. In Table 1, the 14 industries studied are listed in order from 1-14 based on estimated CO2 emissions in 2050 (greatest to least), with columns describing the change in net CO2 emissions after electrification in the baseline and ambitious scenarios across the study period. Plastic recycling, steel reheating processes, steel production, and the ammonia industry are the top four industries in terms of CO2 emissions reduction potential from electrification.

Table 1. Change in CO2 emissions from electrification in China using electrified processes in fourteen industries.

Note: For the steel sector, results are for the H2-DRI production route relative to BF-BOF. We also modeled scrap-EAF vs. BF-BOF and electrolysis vs. BF-BOF, and those results are presented in section 3.11 below. For the plastics recycling sector, results are presented relative to production of virgin resin, as detailed in section 3.4. For Ammonia production, it is unlikely that all electrolysis-based hydrogen production will be based on grid electricity – most will likely have a dedicated renewable electricity supply, which would reduce the estimated increase in emissions.

This study also emphasizes the positive impact of electrification on reducing CO2 emissions over the lifetime of the technology by calculating the cumulative change in CO2 emissions from 2030 to 2050 (Figure 1 and Figure 2). Industrial electrification leads to a net decrease in CO2 emissions over the lifetime of the technologies, assumed to span from 2030 to 2050. These figures indicate that, even if industrial electrification initially causes an increase in annual CO2 emissions due to the high carbon intensity of China’s electricity grid, the long-term effect of electrification will result in a net reduction of CO2 emissions as China’s grid decarbonizes. This demonstrates how industrial electrification contributes to China’s goal of carbon neutrality.

Figure 1. Cumulative change in CO2 emissions over the lifetime of electrified technologies over the period of 2030 - 2050 in four industries studied (Plastic recycling, steel reheating, steel and ammonia) (This is the technical potential assuming a 100% adoption rate, except for the steel industry, where we assumed a more gradual adoption rate of electrified technologies over the study period).

Figure 2. Cumulative change in CO2 emissions over the lifetime of electrified technologies over the period of 2030 - 2050 in ten industries studied (Paper, aluminum, soybean oil, container glass, beet sugar, wet corn milling, beer, ethanol, meat processing, and milk powder) (This is the technical potential assuming 100% adoption rate. In the near term [by 2030], the actual adoption rate will be low. Therefore, in sectors where there is a projected increase in CO2 emissions in 2030, the actual increase will be very small).

We also compared the energy cost per unit of production for the electrified and conventional process in each industry in 2030 and its projection up to 2050 under different future electricity, fuel, and carbon price assumptions. Under the base case energy prices forecast, in many cases, the cost per unit of production for an electrified process is higher than that of the conventional process. For many industries, a scenario with 50% lower electricity prices in 2030 and 2050 compared to the base case forecast can substantially reduce the energy cost of the electrified production processes, making them more cost-competitive compared to the conventional processes. It should also be noted that our cost comparison focuses only on energy costs (with assumed prices on carbon in the future) and does not include capital cost and other potential cost advantages for electrified technologies (see the methodology section).

The study only considers several potential electrification solutions for each process and subsector, such as studying three alternative steel production routes relative to the blast furnace-blast oxygen furnace (BF-BOF) route – scrap-based EAF production, hydrogen-DRI production, and electrolysis-based steelmaking. Other applicable electrified heating technologies might currently exist or are under development, such as DRI-EAF steelmaking with hydrogen-rich gases. Furthermore, additional yet unexplored electrification potential may lie within the studied subsectors. Thus, this study's projected energy savings and CO2 reduction potentials may represent an underestimate of the total potential that full-scale industrial subsector electrification in China could achieve.

Mitigating emissions offers not only global benefits by mitigating climate change but also localized advantages. Industrial plants in China that employ fossil fuels onsite are significant contributors to air pollution, negatively impacting nearby urban areas. These urban communities are particularly susceptible to the adverse effects of this pollution. By transitioning to industrial electrification, China has an opportunity to reduce localized emissions significantly, directly improving the quality of life for the hundreds of millions of people residing in its cities.

The process of electrifying industrial operations in order to gain the related benefits calls for an all-encompassing strategy. Increasing the capacity for renewable electricity generation is a fundamental requirement to satisfy the industrial sector's large demand for clean energy. As the demand for electricity increases due to industrial electrification, there will be an increasing need for both technical and economic enhancements in China's electricity grid and energy market to ensure that energy transmission remains reliable and efficient.

Our analysis puts forth policy recommendations to expedite the electrification of industrial heating in China. One key recommendation is integrating electrification in industrial planning and decision-making establishing industry-specific electrification roadmaps. The introduction of robust standards and regulations, such as green public procurement policies, is crucial for incentivizing industries to adopt cleaner technologies.

To boost the adoption of cutting-edge electrification technologies, we recommend promoting technology demonstrations, establishing pilot projects, and leveraging governmental resources such as the Five-Year Plan for Energy Technology Innovation. We also emphasize the need for financial incentives and grants to reduce upfront costs for manufacturers and encourage renewable electricity procurement. Workforce development is crucial to ensure that professionals are equipped to implement electrification technologies. Lastly, we suggest the development of Public-Private Partnerships to accelerate technology commercialization, facilitate technology transfer, and share the risk associated with investing in new electrified technologies.

To read the full report and see complete results and analysis of this new study, download the full report from the link above.

Register here for today's Report Launch Webinar on November 28, 2023 at 6PM U.S. PT / 9PM U.S. ET [November 29, 2023 at 10AM – 11AM Beijing time]