Green Public Procurement of Steel in India, Japan, and South Korea

Authors: Ali Hasanbeigi, Navdeep Bhadbhade

The global steel industry accounts for around 7% of global greenhouse gas (GHG) emissions and 11% of global CO2 emissions. Substantial cuts in energy demand and CO2 emissions of the global steel industry will be needed by 2030 and thereafter for the world to reach the target of the Paris Climate Agreement: to limit global warming to “well below” 2 ℃.

Governments in India, Japan, and South Korea spend billions of dollars each year on public procurement: the purchase of goods and services by public authorities such as government departments. This large-scale purchasing power gives governments leverage in driving markets toward the development of low-carbon products such as steel used in construction projects.

Green public procurement (GPP) is a policy instrument where public entities seek to procure goods with a reduced environmental impact throughout their lifecycle relative to similar goods that provide the same function. GPP adoption is increasing around the world as national governments, sub-national governments, and multilateral entities develop policies to reduce their carbon footprints and create new low-carbon markets.

This report focuses on three case studies of green public procurement of steel in India, Japan, and South Korea. India, Japan, and South Korea are the 2nd, 3rd, and 6th largest steel-producing countries, respectively. These three countries are among the nations with some of the highest CO2 emissions intensity for their steel industry. This is mainly driven by low share of scrap-based electric arc furnace (EAF) steel production in these countries.

Total steel consumption in Japan and South Korea has remained almost flat in the past decade, while the total steel consumption in India has increased by 63% between 2010 and 2021. It is estimated that steel consumption in India could increase by over four times to around 500 million tonnes (Mt) by 2050. Government-funded construction and infrastructure projects accounted for around 27%, 13%, and 11% of total steel demand in India, Japan, and South Korea in 2019, respectively. The government in these countries can use this purchasing power to stimulate demand for green steel products, especially in India where the share of public procurement of steel is higher.

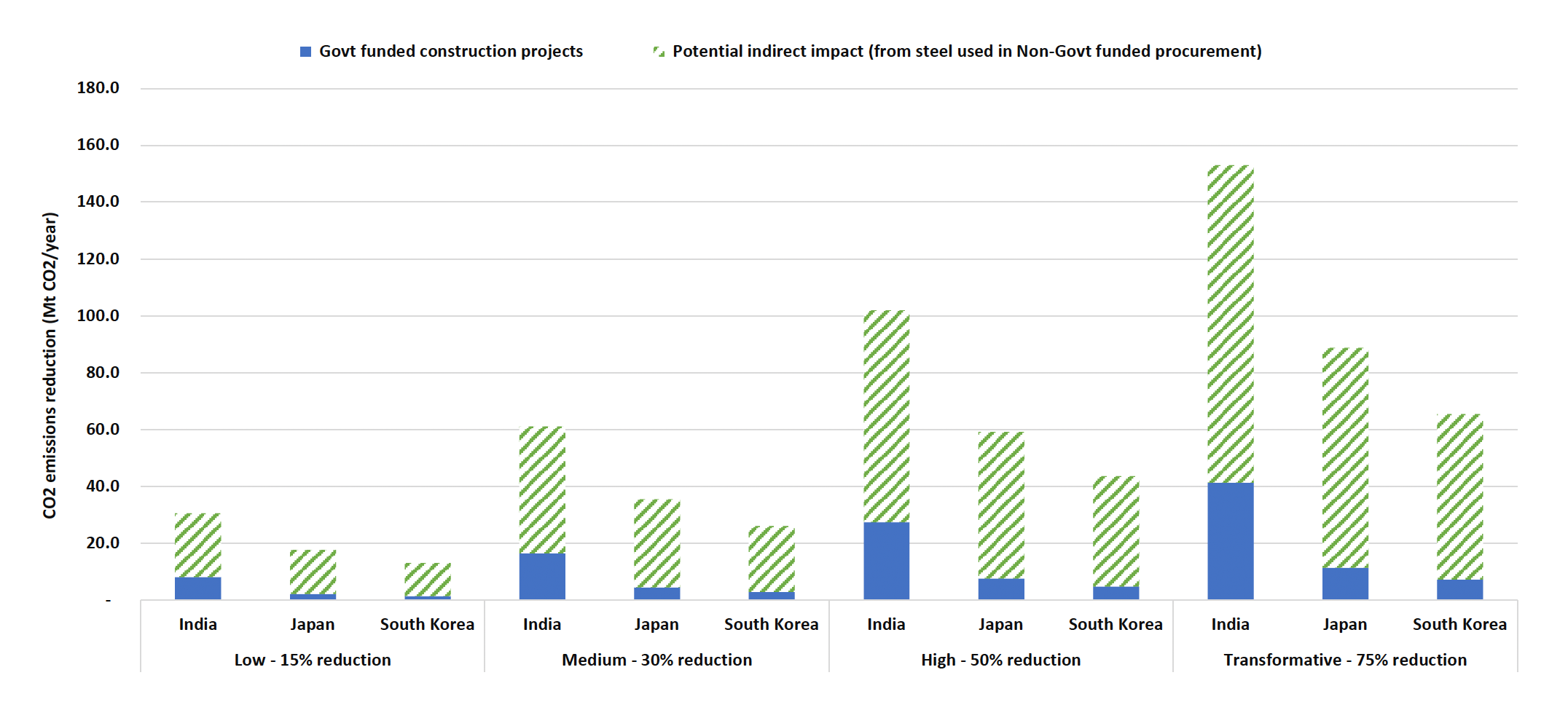

We estimated the CO2 emissions associated with steel used in public construction projects and the potential impact of a GPP policy to reduce those emissions. Public procurement of steel in India, Japan, and South Korea accounted for approximately 55 Mt CO2, 15 Mt CO2, and 10 Mt CO2 emissions in 2019, respectively. Figure 1 shows the annual CO2 emissions reduction potential resulting from GPP of steel in these three countries.

Figure 1. Annual CO2 emissions reduction potential resulted from GPP of steel in India, Japan, and South Korea

Note: Potential indirect impact assumes that changes in steel plants to reduce CO2 emissions would impact the CO2 intensity of all steel products produced and sold, even to non-government-funded projects.

While GPP has political support in these three countries, the pace of implementation could be improved. Japan and South Korea already have well-established GPP programs, but they do not include carbon criteria for steel products. India, however, is further behind and needs to further develop and deploy a coherent national GPP policy which also includes carbon criteria for steel products. Some of the challenges include consistent emissions reporting standards, establishing feasible quantitative limits on embodied carbon, decentralized procurement, and carbon leakage.

Applying learnings from international best practices, we make the following recommendations for a GPP policy for steel in India, Japan, and South Korea:

● Accelerate the creation of the life cycle emissions inventory. This is a crucial step to enable reliable reporting of emissions data and the use of environmental impact in bid evaluation.

● The central government should examine international best practices and evaluate different models to promote or ensure the uptake of GPP at the sub-national level, including creating a mandatory federal backstop program similar to carbon pricing; developing robust national GPP program; and encouraging states/provinces and municipalities to adopt GPP through funds or incentives aimed to top-up spending on infrastructure investments that use green steel products.

● National GPP policy should move quickly to prevent fragmented GPP policies across provinces/states and municipalities. It is easier to build a harmonized framework now than in a few years when more sub-national governments will have their own GPP programs.

● Targets should use a two-tiered approach to promote innovation while maintaining feasibility. Targets should be performance-based, preferring whole-project over product-level analysis where possible. Standards should be adjusted at regular intervals to reflect changes in technology to incentivize innovation continually.

● Build a national team to help national and sub-national agencies implement green steel procurement. This team should build expertise on embodied carbon, lifecycle analysis, and tender creation, publish online resources, and act as consultants to public agencies.

● Invest in tools and capacity-building programs that can be used by sub-national governments and private entities that have low administrative capacity. Many provinces/states and cities with smaller bureaucracies do not have the time and resources to invest in training for GPP procurement. This, paired with the significant amount of procurement that happens at the sub-national level, underscores the importance of the national GPP program investing in tools that automate and simplify the implementation of the GPP policy.

● Build out a portfolio of policies that support industrial decarbonization. A carbon border adjustment mechanism (CBAM) can protect green steel manufacturers from competitors whose prices do not reflect negative environmental externalities. Carbon contracts-for-differences (CCfD) can remove uncertainty over future carbon prices. With GPP creating a demand signal for green steel products, loans and grants for manufacturers can close the loop by helping the supply side pay upfront costs for retrofitting and retraining.

GPP can catalyze significant carbon emissions reductions in the steel industry by acting as a signal of durable demand. This complements ongoing industrial decarbonization policies in India, Japan, and South Korea by demonstrating demand for the growing supply of green steel. Together, these policies can make the steel industry in these countries more globally competitive in the growing market of green steel products. This is especially important and timely as other jurisdictions such as the European Union and the U.S. adopt and strengthen their green public procurement policies.

To read the full report and see complete results and analysis of this new study, download the full report from the link above.

Don't forget to Follow us on LinkedIn, Facebook, and Twitter to get the latest about our new blog posts, projects, and publications.