China’s Steel Transformation:

From Blast Furnaces to Electric Arc Furnaces

The iron and steel industry, one of the most energy-intensive sectors globally, contributes over 7% of total greenhouse gas emissions and over 11% of global carbon dioxide emissions, largely due to the use of coal in traditional blast furnace-basic oxygen furnace (BF-BOF) production.

China, as the world’s largest steel producer, generates nearly half of global crude steel output and has committed to peaking its CO₂ emissions by 2030 and achieving carbon neutrality by 2060. However, the industry’s current reliance on BF-BOF for 90% of production presents a significant challenge to achieving these targets.

This report evaluates the potential of transitioning to scrap-based electric arc furnace (EAF) steelmaking in China, a lower-emission process that could reduce CO₂ emissions by up to 97% when powered by renewable electricity. This study analyzes the emissions, energy, and economic impacts of increased EAF adoption, assesses China’s scrap steel supply chain and regulatory landscape, and provides policy recommendations to support the industry’s shift toward sustainable steel production.

China, the world’s largest consumer of steel scrap, has steadily increased its scrap consumption as part of its efforts to decarbonize its steel industry. In 2022, China consumed around 225 million tons (Mt) of scrap, with projections indicating a rise to over 300 Mt by 2030, driven by domestic scrap availability. The relatively short lifespan of steel products in China, averaging 25 years, means a significant amount of steel will become scrap in the coming decades, adding to the country’s supply. This expected increase in scrap availability positions China to meet its steel industry's future demand, although supply remains unevenly distributed across China’s provinces.

China’s approach to scrap quality and processing has evolved to address challenges related to contamination and inconsistencies in processing standards. Many scrap processing facilities are small-scale and lack advanced sorting technologies, which results in inconsistent quality and efficiency. To support higher scrap quantity and quality, China has implemented preferential tax policies and regulatory measures to encourage formalization, technological upgrades, and better quality control in the scrap processing sector.

We modeled the emissions impact of China’s transition to scrap-EAF steelmaking across four scenarios: Business as Usual (BAU), Moderate, Advanced, and Net-Zero, each incorporating different levels of energy efficiency, fuel switching, and scrap-EAF adoption. Under the BAU scenario, scrap use is projected to increase from 224 Mt in 2020 to 397 Mt by 2050, reducing annual CO₂ emissions by 383 Mt CO2/year in 2050 compared to 2020 levels under the BAU (Figure 1). The Net-Zero scenario, which assumes the highest level of scrap-EAF adoption, forecasts scrap use to reach 487 Mt by 2050, leading to an annual CO₂ emissions reduction of 657 Mt CO2/year in 2050 compared to 2020. Larger CO2 reduction potential under the Net-Zero scenario is not only the result of higher scrap steel use in the steel industry but also more rapid decarbonization of the electricity supply under the Net-Zero scenario by 2050. For comparison, the total annual CO₂ emissions of the steel industry in China was around 2,100 Mt CO2 and in the U.S. (the 4th largest steel producer in the world) was around 85 Mt CO2 in 2021.

Figure 1: Scrap consumption forecast in China’s steel industry under different decarbonization scenarios, 2020-2050 (top) and annual CO2 emissions reduction from 2020 levels resulting from increased use of scrap in the Chinese steel industry and decarbonization of the electricity supply under different scenarios (bottom) (Source: this study)

The transition to scrap-EAF steelmaking in China will lead to an increase in electricity demand, with consumption projected to rise from 58 TWh in 2020 to as much as 264 TWh by 2050 under a Net-Zero scenario. While the increase in load, reaching up to 40 GW, will place additional pressure on China’s electricity grid, it remains small relative to the country’s overall installed capacity and rapidly growing renewable capacity, which saw record solar and wind installations in 2023. However, China’s grid must address challenges in grid stability, inter-provincial trading limitations, and renewable integration, especially as sectors beyond steel also electrify to meet decarbonization targets. To facilitate decarbonization in EAF steel production, Chinese companies have multiple options for renewable energy procurement beyond direct grid use, including Green Power Trading (GPT), Green Electricity Certificates (GECs), direct utility-scale renewable investments, and on-site generation. As China’s corporate renewable energy market matures, these procurement mechanisms will increasingly support scrap-EAF producers in securing stable, low-carbon energy sources to complement the grid’s gradual decarbonization.

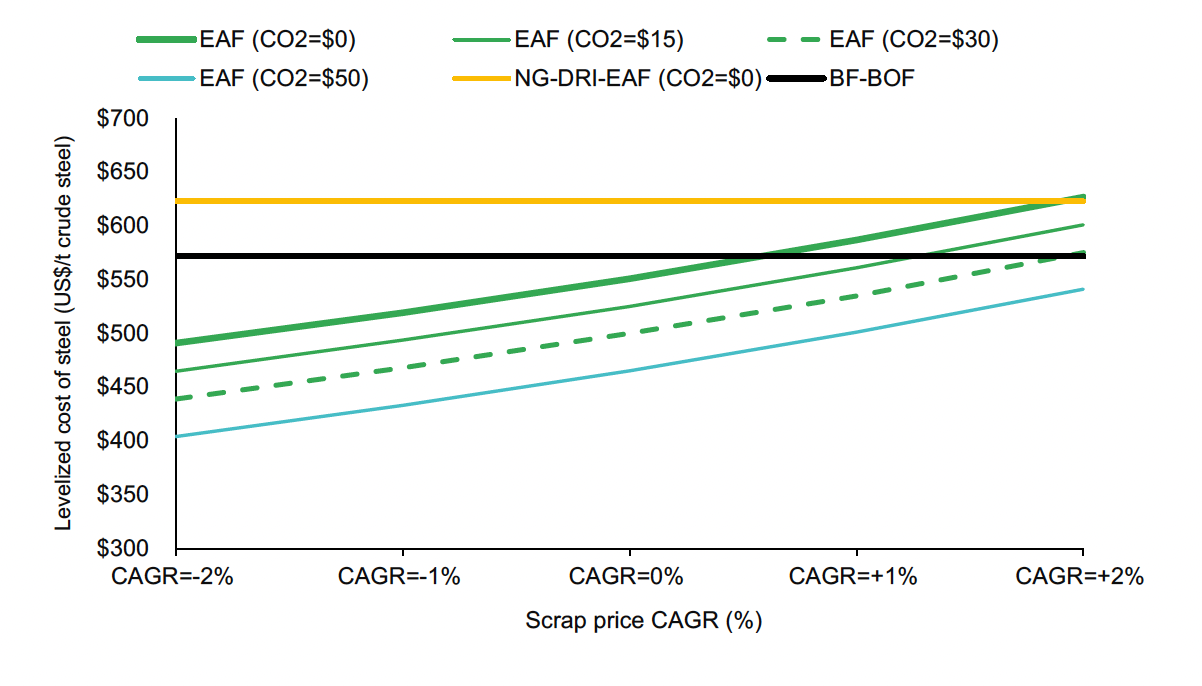

We also conducted an analysis of the levelized cost of steel (LCOS) for scrap-EAF production in China, showing that, under stable or decreasing scrap prices, EAF steelmaking is cost-competitive with traditional Blast Furnace-Basic Oxygen Furnace (BF-BOF) and Natural Gas-Direct Reduced Iron (NG-DRI-EAF) methods. With carbon pricing starting at $15 per ton, EAF becomes increasingly economical, reaching $404 per ton at $50 per ton CO₂ with lower scrap price growth rates (China’s national emissions trading system is expected to cover the steel industry by the end of 2024). Production cost breakdowns show that scrap constitutes 77% of EAF costs, highlighting the importance of stable scrap prices for EAF’s economic feasibility. While coal and coke dominate BF-BOF costs, scrap dependency in EAF emphasizes the need for consistent scrap supply to maintain cost advantages over other steel production routes.

Figure 2. Levelized Cost of Steel ($/t crude steel) with varied scrap price CAGR at different carbon prices in China (Source: this study)

Notes: 5% steel scrap is assumed to be used in both BF-BOF and DRI routes. For this analysis, it is assumed that carbon pricing will be applied in the form of credits or allowances for green scrap-EAF plants. Eligible plants would receive carbon credits based on the reduction of their carbon intensity relative to the benchmark set by BF-BOF operations, which can then be traded on the carbon market.

To maximize climate benefits, China’s EAF expansion must pair demand-side targets (e.g., 20% EAF adoption by 2030) with robust supply-side policies. This includes enhancing scrap availability through stricter recycling mandates and tax incentives for scrap processors to formalize and upgrade infrastructure. Safeguards like scrap source certification—tracking landfill diversion or newly recovered streams—are critical to ensure additionality and avoid displacing existing scrap flows. Maintaining low contamination levels (particularly copper) in available scrap is essential, requiring upfront use design considerations and rigorous end-of-life sorting to preserve quality and enable high-grade EAF steel production. Regionally, prioritize EAF deployment in eastern provinces (Jiangsu, Guangdong, Zhejiang), where scrap surpluses, advanced infrastructure, and clean energy grids align to minimize emissions. Financial incentives, such as tax breaks and subsidies for EAF operators who adopt best practices might be needed for offsetting initial costs.

Additional measures include integrating renewable energy into EAF electricity supply through mechanisms like Green Power Trading, expanding renewable energy certificates, and advancing interprovincial power market reforms to increase access to low-carbon power sources. Collaboration among SMEs, stronger oversight, and international benchmarking, particularly from countries with significant EAF capacity like the USA, Spain, and Turkey, could provide China with a strategic path to scaling low-carbon, scrap-based steel production.

As China transitions from carbon-intensive BF-BOF steel production to lower-carbon EAF steelmaking, it will gradually reduce its exposure to carbon tariffs like the EU CBAM. Currently, China's steel exports face a competitive disadvantage due to high emissions, making them more susceptible to CBAM costs and potential market share losses. However, by increasing the share of scrap-based EAF production and integrating more renewable energy, China can significantly lower the carbon intensity of its steel exports. Over time, this shift will help mitigate the impact of CBAM policies, improving the competitiveness of Chinese steel in global markets that increasingly prioritize low-carbon steel.

To read the full report and see complete results and analysis of this new study, download the full report from the link above.

Interested in data and decarbonization studies on the global steel industry? Check out our list of steel industry publications on this page.

Don't forget to follow us on LinkedIn and X to get the latest about our new blog posts, projects, and publications.